Economists and Experts on Why Private Equity is Critical for Diversified Portfolios

In addition to delivering strong returns, private equity also represents one of the most stable and secure long-term investments for institutional investors. As public markets grow more volatile, private equity serves as an increasingly important tool for diversified pension funds looking for reliable investments that can weather these abrupt shifts in market sentiment. Read below to hear from economists and academic experts on why private equity is a critical asset class for diversified public pension funds.

Northwestern Kellogg School – The Great Recession offered the ultimate validation of private equity’s long-term stability. A study by the Kellogg School of Public Management at Northwestern University found that “companies backed by private equity firms were more resilient in the face of the financial crisis compared to their counterparts.”

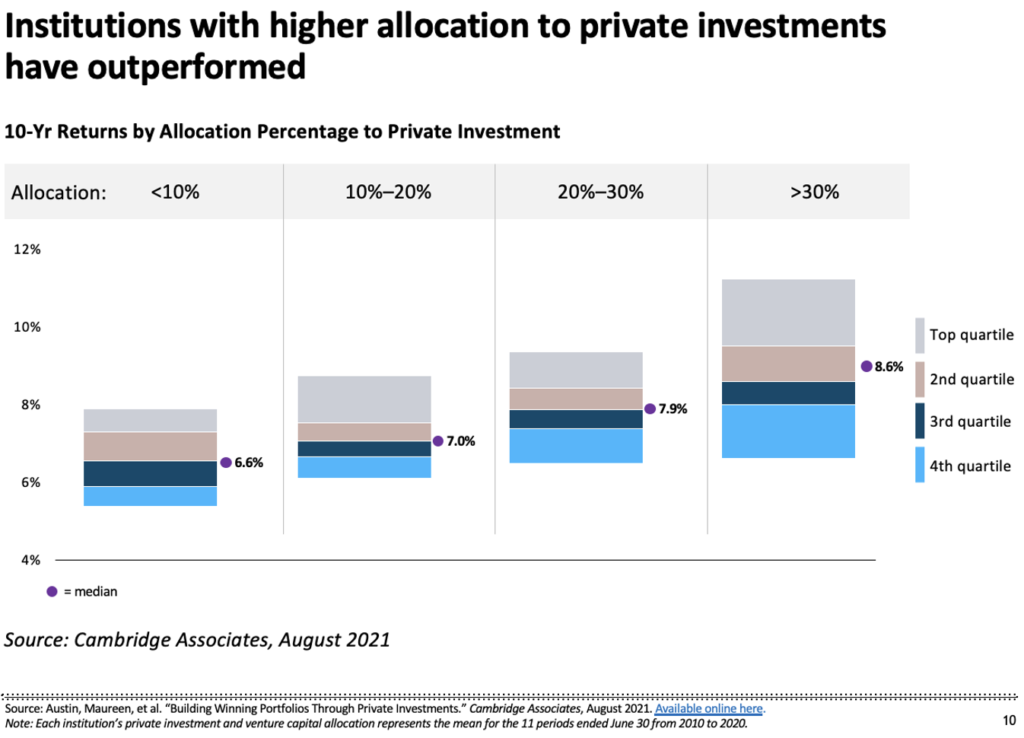

Cambridge Associates – A recent study published by Cambridge Associates found that over the last decade, “institutions with higher private investment allocations experienced higher returns historically. And, those returns tended to be less volatile.” In addition, institutions with higher allocations to private investments have outperformed those with lower allocations.

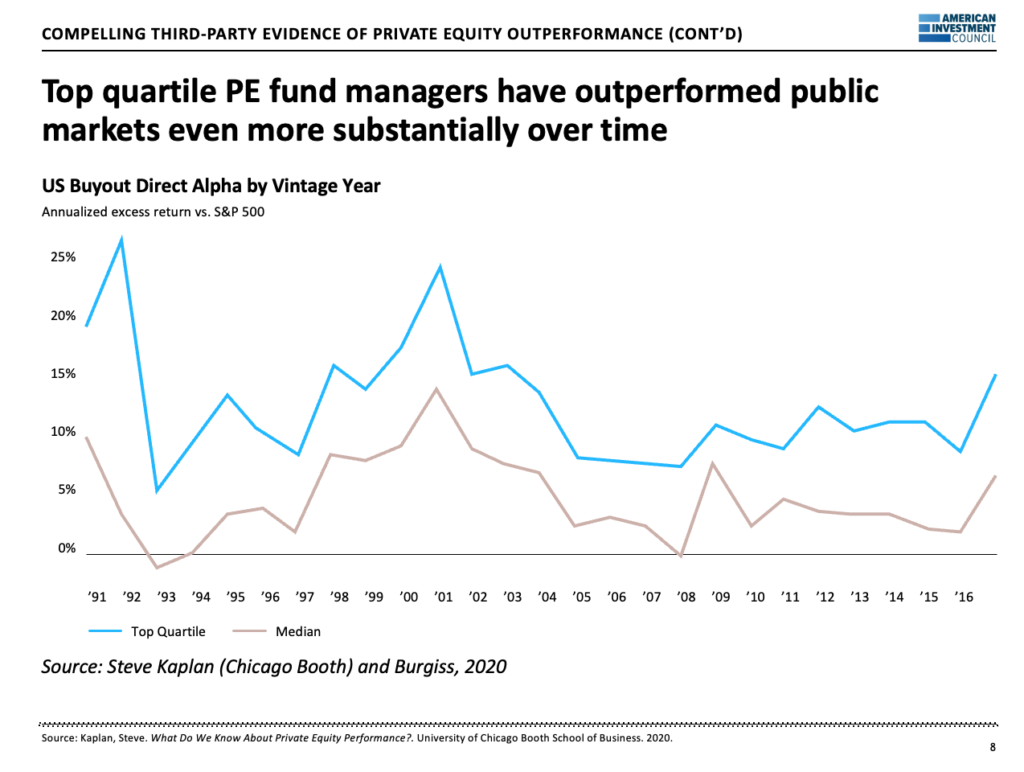

Professor Steve Kaplan of the University of Chicago Booth School of Business found that top quartile private equity fund managers have overperformed public markets dating back to 1991.

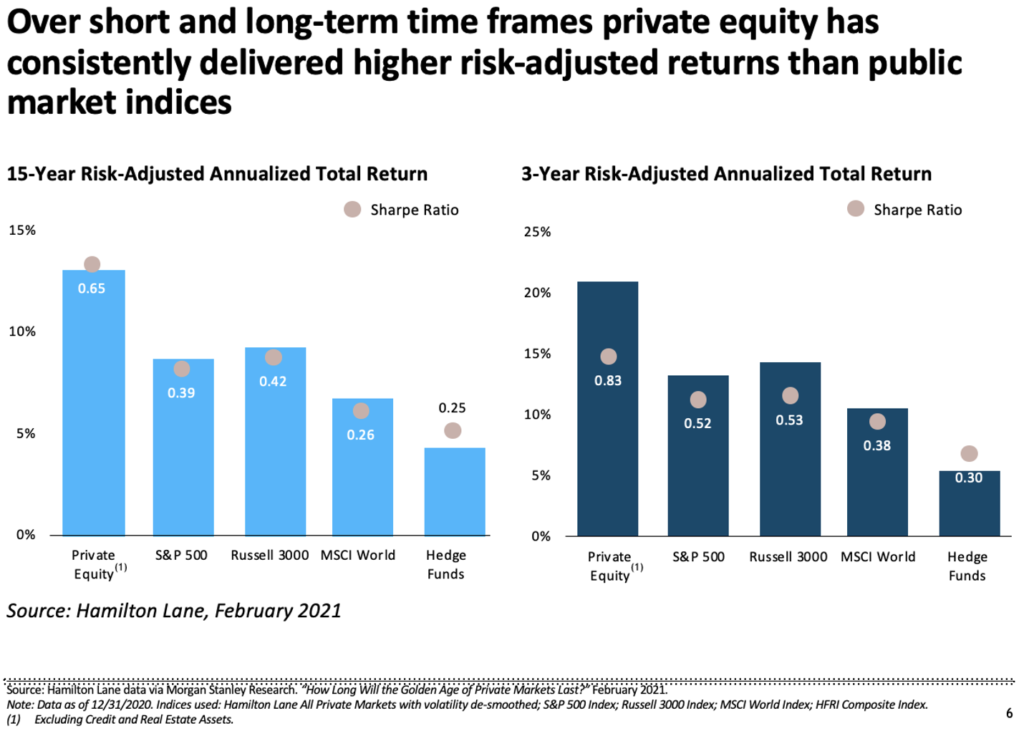

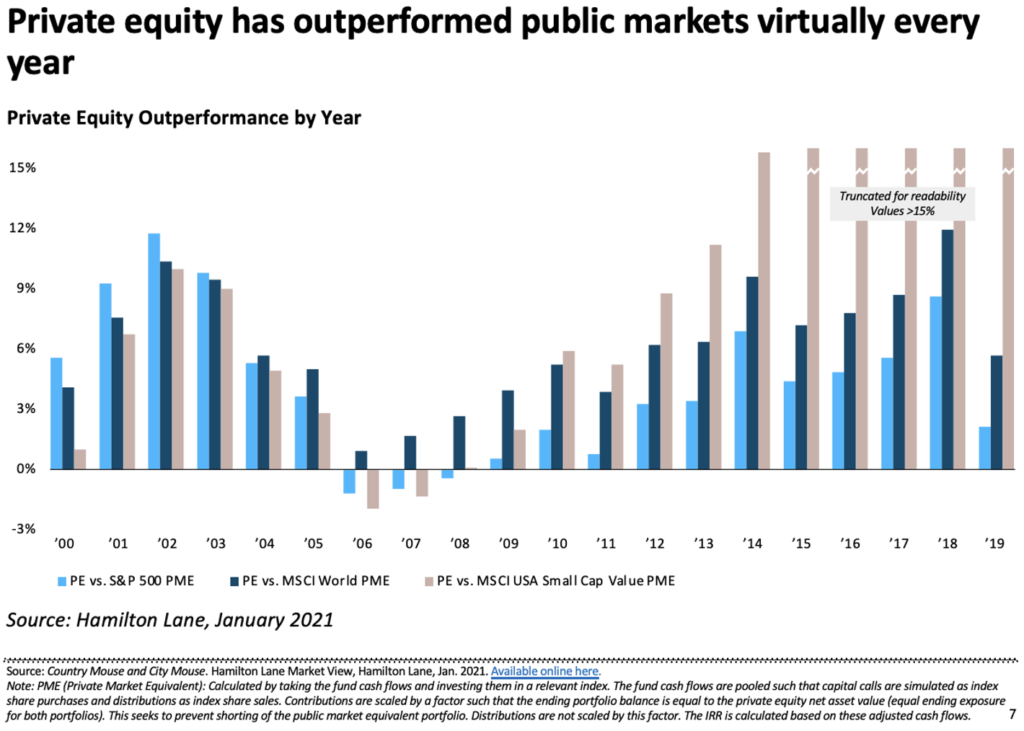

Hamilton Lane, an alternative asset investment advisory firm, found that private equity consistently delivers higher risk-adjusted returns than public markets. Private equity has also outperformed public markets virtually every year.

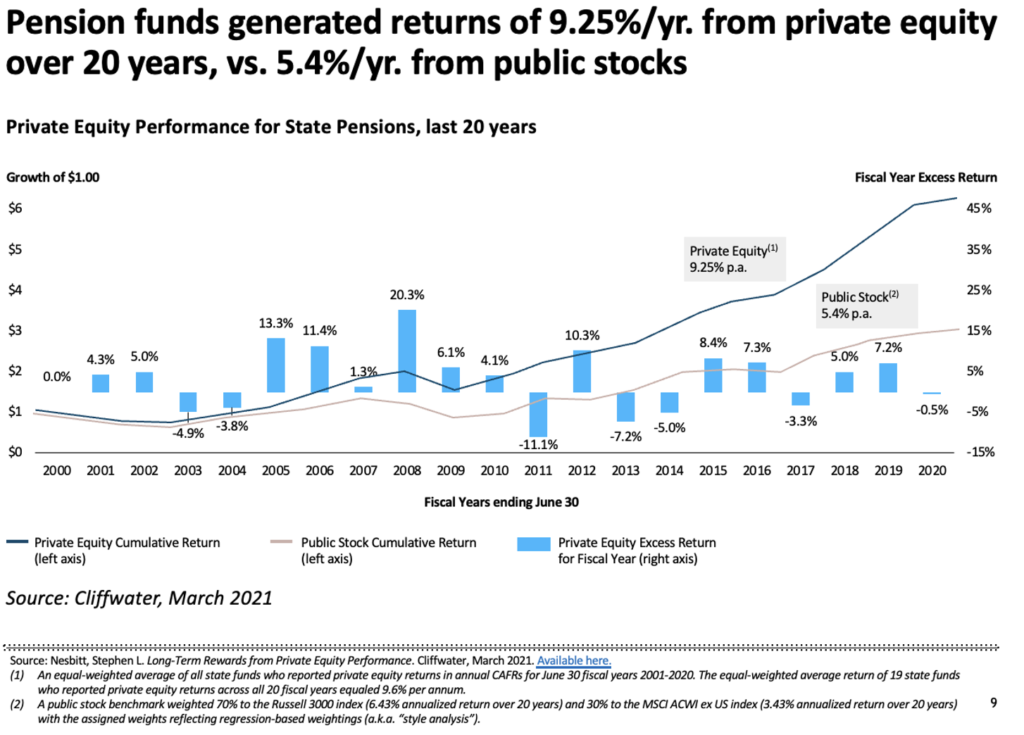

Cliffwater, an investment advisory firm, found that public pension funds have generated nearly twice the returns on private equity investments than from public stocks on investments dating from 2000 to 2020.